Transfer Money from PayPal Directly to Your Bank Account To access your money fast and avoid PayPal fees, you should do one of two things. How you take your money out of PayPal can be just as important as how you receive it. Change How You Withdraw Your Money From PayPal You just need to make sure your business can handle the change in cash flow that comes with only getting paid once a month instead of more often. Yes, it’s only $0.49 per transaction, but savings is savings.

#PAYPAL FEE PLUS#

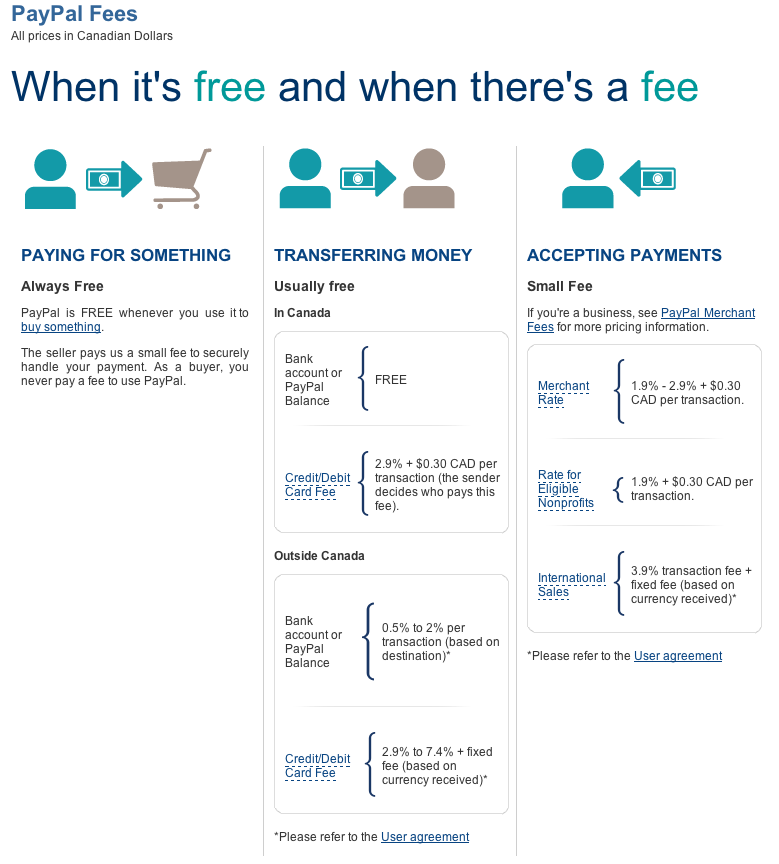

The fee for each transaction is $0.49 USD, plus 3.49% of the amount you receive from U.S.-based clients.įor funds being received from someone outside the U.S., the fee for each transaction is 4.99% plus a fixed fee that varies depending on the country where the funds are coming from.īy opting to be paid only once a month you’ll avoid some of these one-time transaction PayPal fees. This is because PayPal not only charges you a percentage of the money you receive, but they also charge you a fee for every transaction. But, one major downside is paying more PayPal fees. There are a lot of benefits to getting paid more often, such as avoiding cash flow problems in your business. I have some clients who pay me weekly, some that pay me twice a month, and others that only pay me once a month. One way to lower your PayPal fees is to opt to be paid less often. Keep reading to learn 8 ways to decrease or avoid PayPal fees so you can keep more of your hard-earned money: 1.

#PAYPAL FEE HOW TO#

How to Avoid PayPal FeesĪs a freelancer, if you can avoid PayPal fees (or lower them), then you can help your bottom line. PayPal’s 3.49% amounts to $34.90, plus there is the fixed fee of 49 cents. Let’s say you invoice a client for $1,000, and the client opts to pay you through PayPal. Generally, in the United States, companies will pay a commercial fee of 3.49% of the transaction amount plus a fixed fee of 49 cents. When businesses accept payments via PayPal, they get charged a percentage of the sale and a fixed fee. PayPal is convenient, but it is not always free. It used to be if you wanted to accept credit cards, then you needed to open up a merchant account and purchase expensive equipment to swipe credit cards. Thousands of online companies use PayPal as their payment processor. You remain entitled to demonstrate that our losses were below the amount of the fee.PayPal is “a worldwide online payments system that supports online money transfers and serves as an electronic alternative to traditional paper methods like checks and money orders,” according to Wikipedia. The fee is based on our losses in such case. We will not charge you for records requested in connection with your good-faith assertion of an error in your PayPal account. This fee will apply for requests of information relating to why we had reasonable justification to refuse your payment order. See Inactive PayPal Account Fee Table below. The inactivity fee will be the lesser of the fee listed below or the remaining balance in your account. See Credit Card and Debit Card Link and Confirmation Table below.

#PAYPAL FEE VERIFICATION#

This amount will be refunded when you successfully complete the credit card or debit card verification process. Some users, in order to increase their sending limit or as PayPal may determine, may be charged a credit card and debit card link and confirmation fee. This fee is charged when a withdrawal/transfer out of PayPal is attempted by a user and it fails because incorrect bank account information or delivery information is provided.Ĭredit Card and Debit Card Confirmation(s)

#PAYPAL FEE CODE#

For a complete listing of PayPal market codes, please access our Market Code Table.īank Return on Withdrawal/Transfer out of PayPal Market Code Table: We may refer to two-letter market codes throughout our fee pages. International euro (EUR) or Swedish krona (SEK) transactions where both the sender and the receiver are registered with or identified by PayPal as resident in the European Economic Area (EEA) are treated as domestic transactions for the purpose of applying fees. For a listing of our groupings, please access our Markets/Region Grouping Table. Certain markets are grouped together when calculating international transaction rates. International: A transaction occurring when the sender and receiver are registered with or identified by PayPal as residents of different markets.

Domestic : A transaction occurring when both the sender and receiver are registered with or identified by PayPal as residents in the European Economic Area (EEA). You can also view these changes by clicking ‘Legal’ at the bottom of any web-page and then selecting ‘Policy Updates’. You can find details about changes to our rates and fees and when they will apply on our Policy Updates Page.

#PAYPAL FEE PDF#

Download printable PDF Last Updated: 1, August 2022

0 kommentar(er)

0 kommentar(er)